Easy Fixes for Everyday Hassles

At Your Business Dairy, we understand life can get pretty busy! That’s why we bring you short, simple articles that help you stay updated on what’s trending, introduce you to new ideas, and share useful tips – all in a way that fits into your hectic schedule.

Fintech

बाजार में आ चुका है टाटा टेक्नोलॉजी (Tata Technologies) का आईपीओ(IPO) जानिए क्या होगा खरीदने की तारीख, और भी बहुत कुछ

Posts List Fintech बाजार में आ चुका है टाटा टेक्नोलॉजी (Tata Technologies) का आईपीओ(IPO) जानिए…

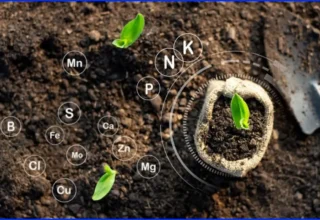

Agriculture

Top 3 Organic Fertilizer Manufacturing Companies In India

Posts List Fintech बाजार में आ चुका है टाटा टेक्नोलॉजी (Tata Technologies) का आईपीओ(IPO) जानिए…

बाजार में आ चुका है टाटा टेक्नोलॉजी (Tata Technologies) का आईपीओ(IPO) जानिए क्या होगा खरीदने की तारीख, और भी बहुत कुछ

yourbusinessdiary.com 19 November 2023 0Posts List Fintech बाजार में आ चुका है टाटा टेक्नोलॉजी (Tata Technologies) का आईपीओ(IPO) जानिए क्या होगा खरीदने की तारीख, और भी बहुत कुछ Posts…

Top 3 Upcoming Smartphones Under 10K in 2024

yourbusinessdiary.com 18 November 2023 0Top 3 Organic Fertilizer Manufacturing Companies In India

yourbusinessdiary.com 17 November 2023 0Posts List Fintech बाजार में आ चुका है टाटा टेक्नोलॉजी (Tata Technologies) का आईपीओ(IPO) जानिए…